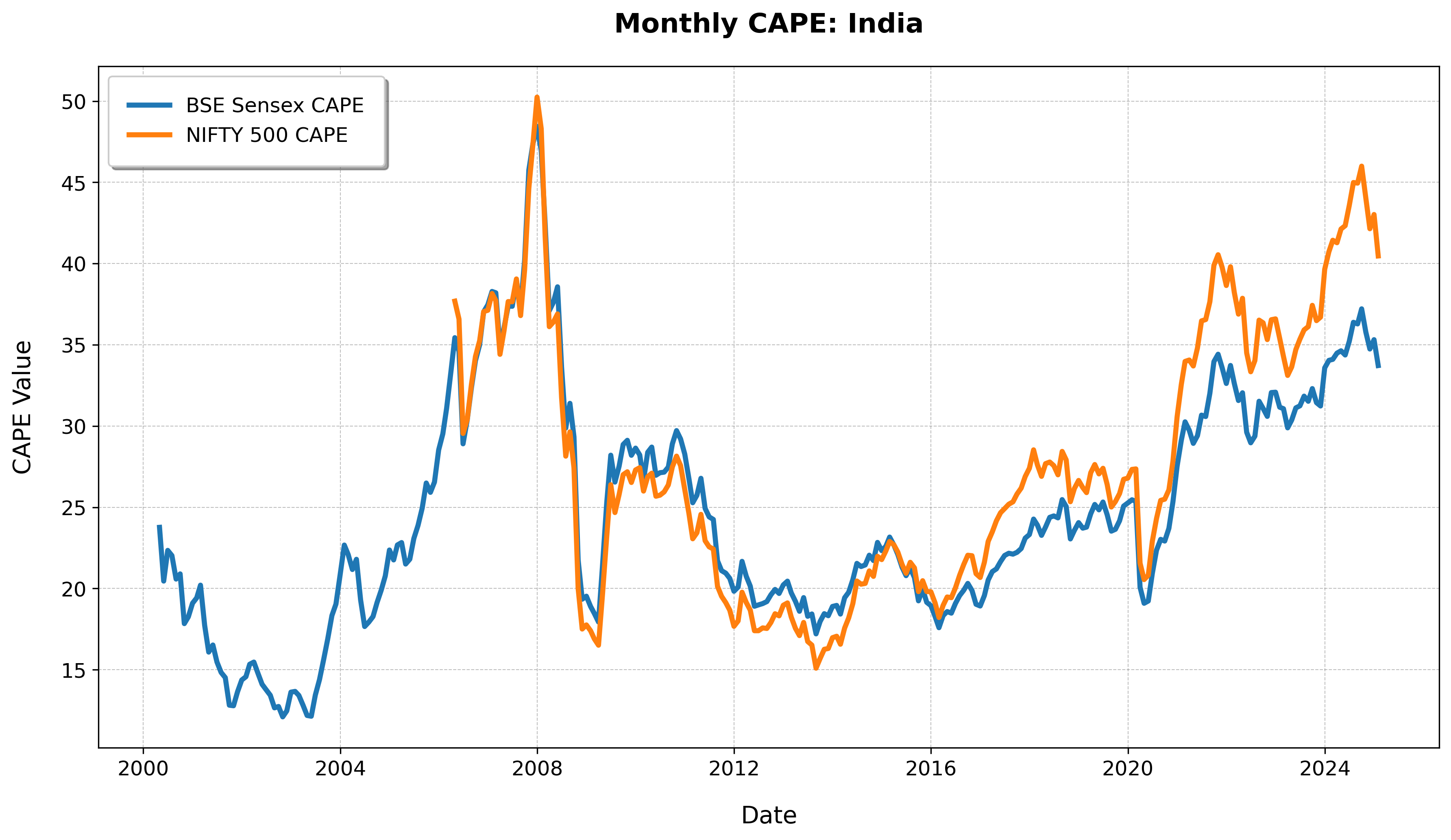

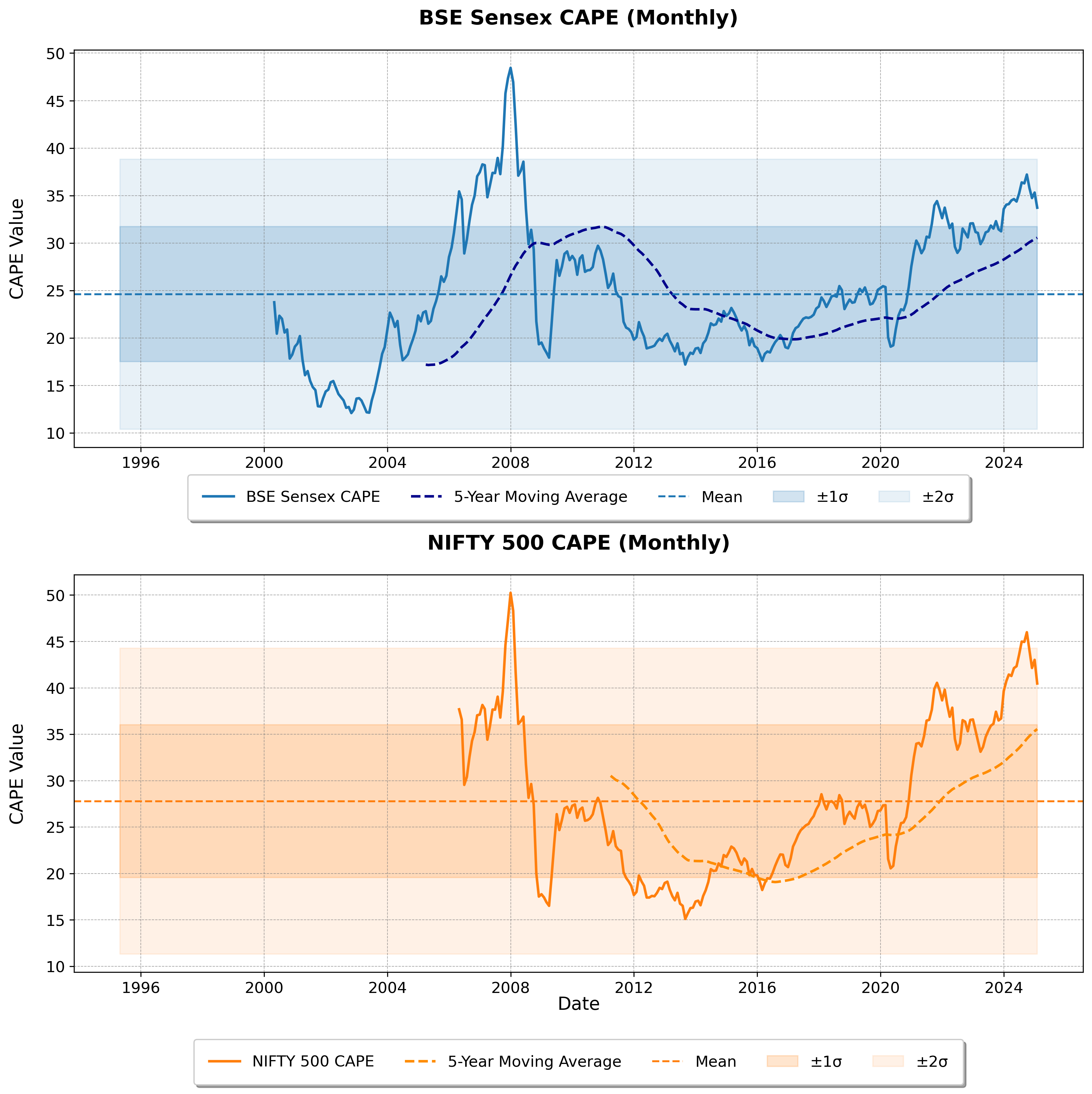

The Cyclically Adjusted Price Earnings (CAPE) ratio, introduced in 1988 by economists Professor Robert Shiller and John Y. Campbell, enhances the traditional Price/Earnings (PE) ratio by addressing its short-term volatility. Unlike the traditional PE ratio, which uses the most recent one year of earnings, the CAPE ratio averages inflation-adjusted earnings over a ten-year period. This longer horizon smooths out short-term fluctuations caused by business cycles, providing a clearer signal of long-term market valuation. This makes the CAPE ratio a valuable tool for identifying long-term investment opportunities.

Scope and Methodology: This data library provides regularly updated estimate CAPE for the Indian equity market using data from BSE Sensex and Nifty 500 Indices with 10, 7, and 5 year business cycle duration. The methodology is described in more detail in our Working Paper: Joshy Jacob and Rajan Raju (2024) “Forecast or Fallacy? Shiller's CAPE and Market and Style Factor Forward Returns in Indian Equities” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4911989

Downloadable Data Files

Monthly India CAPE Estimates: April 2006 - January 2026 CSV

Visualisations